Phase 1 study of FPI-1434 progressing towards multi-dose data and recommended Phase 2 dose in 1H2022

FPI-1966 advancing to clinic

HAMILTON, ON and BOSTON, Aug. 10, 2021 /PRNewswire/ -- Fusion Pharmaceuticals Inc. (Nasdaq: FUSN), a clinical-stage oncology company focused on developing next-generation radiopharmaceuticals as precision medicines, today announced financial results for the second quarter ended June 30, 2021 and provided an update on clinical and corporate developments.

"We are building a fully integrated radiopharmaceutical company based upon our platform, reflecting a diverse pipeline of targeted alpha therapies in development supported by manufacturing and supply chain expertise," said Chief Executive Officer John Valliant, Ph.D. "We expect to have three clinical programs employing differentiated radiopharmaceuticals underway by mid-next year. In addition to our ongoing Phase 1 study of FPI-1434, the investigational new drug application (IND) of FPI-1966 was recently cleared by the U.S. Food & Drug Administration (FDA), and we intend to submit an IND application for FPI-2059 in the first half of 2022. In parallel, we are quickly advancing programs under our partnership agreement with AstraZeneca and are planning for a combination study of FPI-1434 with KEYTRUDA® (pembrolizumab)."

Dr. Valliant continued, "These programs, along with our work to build Fusion's radiopharmaceutical manufacturing capabilities with a new facility, demonstrate the depth and versatility of our pipeline and the potential to use our expertise to create innovative treatments for a broad array of solid tumors with high unmet medical need."

Recent Highlights and Future Milestones

Corporate Updates

- On July 28, Fusion announced the FDA cleared the Company's Investigational New Drug (IND) application for FPI-1966. FPI-1966 is a targeted alpha therapy (TAT) designed to use vofatamab, a human monoclonal antibody, to target and deliver actinium-225 to tumor sites expressing fibroblast growth factor 3 (FGFR3), a protein that is overexpressed in multiple tumor types, particularly head and neck and bladder cancers. Fusion plans to initiate a Phase 1, non-randomized, open-label clinical trial in patients with solid tumors expressing FGFR3 intended to investigate safety, tolerability and pharmacokinetics and to establish the recommended Phase 2 dose. The Company anticipates initiating the Phase 1 study around the end of 2021 and reporting interim data from the first patient cohort around the end of 2022.

- On June 14, Fusion announced the presentation of preliminary Phase 1 data from the single-dose portion of the study at the Society of Nuclear Medicine and Molecular Imaging (SNMMI) Virtual Annual Meeting. Results from the first three patient cohorts (n=12) demonstrated a favorable safety profile for FPI-1434. No drug-related serious adverse events and/or dose limiting toxicity were reported in administered activity up to 40kBq/kg body weight and dosimetric results were within normal organ radiation tolerability limits.

- On June 14, Fusion also announced preclinical data demonstrating synergistic efficacy against olaparib-resistant colorectal and radioresistant lung cancer xenografts when combining FPI-1434 with olaparib, and preclinical data showing that treatment with FPI-1434 in combination with immune checkpoint inhibitors resulted in complete tumor eradication.

- On June 2, Fusion announced that the Company entered a 15-year lease agreement with Hamilton, Ontario-based McMaster University to build a 27,000 square foot current Good Manufacturing Practice (GMP) compliant radiopharmaceutical manufacturing facility. The facility, to be built by McMaster and equipped and validated by Fusion, will be designed to support manufacturing of the Company's growing pipeline of targeted alpha therapies (TATs).

FPI-1434 Monotherapy

- Fusion continues to advance the multi-dose portion of its Phase 1 study evaluating FPI-1434 in patients with advanced solid tumors. The dose-finding study is enrolling patients at sites in Canada, the United States and Australia.

- Fusion anticipates reporting Phase 1 multi-dose safety and imaging data, and the recommended Phase 2 dose and schedule, in the first half of 2022.

FPI-1434 Combination Therapy

- Fusion has evaluated FPI-1434 in preclinical studies in combination with approved checkpoint and DNA damage response inhibitors, including PARP inhibitors, and believes the synergies observed could expand the addressable patient populations for FPI-1434 and allow for potential use in earlier lines of treatment.

- Fusion anticipates the initiation of a Phase 1 combination study with FPI-1434 and KEYTRUDA® (pembrolizumab) to occur six to nine months following determination of the recommended Phase 2 dose of FPI-1434 monotherapy.

FPI-2059

- FPI-2059 is a small molecule radioconjugate in development as a targeted alpha therapy for various solid tumors. The molecule targets neurotensin receptor 1 (NTSR1), a promising target for cancer treatment, that is overexpressed in multiple solid tumors. FPI-2059 combines Ipsen's IPN-1087, which Fusion acquired in 2021, with actinium-225. Fusion anticipates submitting an IND application for FPI-2059 in the first half of 2022.

Second Quarter 2021 Financial Results

- Cash and Investments: As of June 30, 2021, Fusion held cash, cash equivalents and investments of $260.5 million, compared to cash, cash equivalents and investments of $299.5 million as of December 31, 2020. Fusion expects its cash, cash equivalents and investments as of June 30, 2021 will enable the Company to fund its operations through the end of 2023.

- Collaboration Revenue: For the second quarter of 2021, Fusion recorded $0.5 million of revenue under the AstraZeneca collaboration agreement.

- R&D Expenses: Research and development expenses for the second quarter of 2021 were $21.1 million, compared to $3.3 million for the same period in 2020. The increase was primarily related to increased platform development and research activities, clinical activities related to the ongoing Phase 1 clinical trial of FPI-1434, asset purchase agreements and preclinical research and manufacturing costs.

- G&A Expenses: General and administrative expenses for the second quarter of 2021 were $6.6 million, compared to $4.0 million for the same period in 2020. The increase was primarily related to personnel related costs, including salary, benefits and stock compensation due to hiring, as well as general corporate costs, including expenses for general corporate, director and officer insurance.

- Net Loss: For the second quarter of 2021, Fusion reported a net loss of $26.9 million, or $0.63 per share, compared with a net loss of $44.7 million, or $18.91 per share, for the same period in 2020. On a non-GAAP basis, excluding a change in fair value of preferred share tranche right liability and warrant liability, net loss was $7.1 million for the second quarter of 2020.

Impact of COVID-19

While Fusion is progressing the multi-dosing portion of the Phase 1 clinical trial of FPI-1434, the Company has experienced material delays in patient recruitment and enrollment as a result of continued resourcing issues related to COVID-19 at trial sites.

Moreover, there remains uncertainty relating to the trajectory of the pandemic and whether it may cause further delays in patient study recruitment. The impact of related responses and disruptions caused by the COVID-19 pandemic may result in difficulties or delays in initiating, enrolling, conducting or completing the planned and ongoing trials and the incurrence of unforeseen costs as a result of disruptions in clinical supply or preclinical study or clinical trial delays. The continued impact of COVID-19 on results will largely depend on future developments, which are highly uncertain and cannot be predicted with confidence.

About Fusion

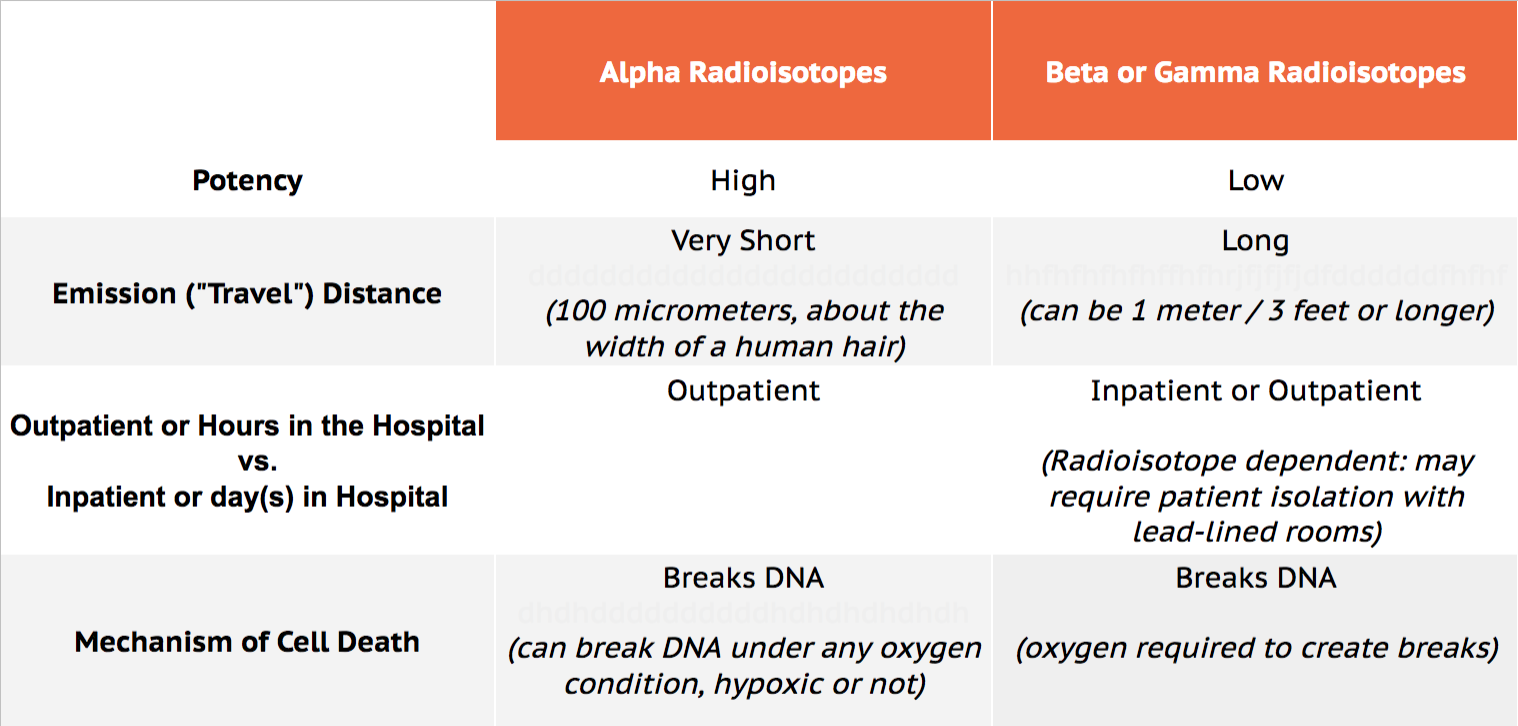

Fusion Pharmaceuticals is a clinical-stage oncology company focused on developing next-generation radiopharmaceuticals as precision medicines. Employing a proprietary Fast-Clear™ linker technology, Fusion connects alpha particle emitting isotopes to various targeting molecules in order to selectively deliver the alpha emitting payloads to tumors.

Fusion's lead program, FPI-1434 targeting insulin-like growth factor 1 receptor, is currently in a Phase 1 clinical trial. The pipeline includes FPI-1966 targeting the fibroblast growth factor receptor 3 (FGFR3) and FPI-2059, a small molecule recently acquired from Ipsen, targeting neurotensin receptor 1 (NTSR1). In addition to a robust proprietary pipeline, Fusion has a collaboration with AstraZeneca to jointly develop up to three novel targeted alpha therapies (TATs) and explore up to five combination programs between Fusion's TATs and AstraZeneca's DNA Damage Repair Inhibitors (DDRis) and immuno-oncology agents. Fusion also entered into a collaboration with Merck to evaluate FPI-1434 in combination with Merck's KEYTRUDA® (pembrolizumab) in patients with solid tumors expressing IGF-1R.

Forward-Looking Statements

Certain statements set forth in this press release constitute "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements can be identified by terms such as "believes," "expects," "plans," "potential," "would" or similar expressions and the negative of those terms. Such forward-looking statements involve substantial risks and uncertainties that could cause Fusion's research and clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainties inherent in the drug development process, including Fusions' programs' early stage of development, the ability to move in-licensed targets forward in the clinic, the process of designing and conducting preclinical and clinical trials, the regulatory approval processes, the timing of regulatory filings, the challenges associated with manufacturing drug products generally and radiopharmaceuticals specifically, Fusion's ability to successfully establish, protect and defend its intellectual property, risks relating to business interruptions resulting from the coronavirus (COVID-19) disease outbreak or similar public health crises and other matters that could affect the sufficiency of existing cash to fund operations. Fusion undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the company in general, see Fusion's annual report on Form 10-Q for the quarter ended March 31, 2021 which is available on the Securities and Exchange Commission's website at www.sec.gov and Fusion's website at www.fusionpharma.com.

Investors and others should note that Fusion communicates with its investors and the public using the Fusion website, www.fusionpharma.com, including, but not limited to, company disclosures, investor presentations, SEC filings, and press releases. The information that Fusion posts on this website could be deemed to be material information. As a result, Fusion encourages investors, media and others interested to review the information that Fusion posts there on a regular basis.

FUSION PHARMACEUTICALS INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except share amounts) (Unaudited) | ||||

June 30, | December 31, | |||

Assets | ||||

Current assets: | ||||

Cash and cash equivalents | $ 27,615 | $ 90,517 | ||

Accounts receivable | 121 | — | ||

Short-term investments | 150,904 | 131,882 | ||

Prepaid expenses and other current assets | 5,847 | 5,340 | ||

Restricted cash | 669 | 425 | ||

Total current assets | 185,156 | 228,164 | ||

Property and equipment, net | 2,659 | 1,967 | ||

Deferred tax assets | 1,067 | 653 | ||

Restricted cash | 1,222 | 1,466 | ||

Long-term investments | 81,974 | 77,082 | ||

Operating lease right-of-use assets | 7,224 | — | ||

Other non-current assets | 2,854 | 1,344 | ||

Total assets | $ 282,156 | $ 310,676 | ||

Liabilities and Shareholders' Equity | ||||

Current liabilities: | ||||

Accounts payable | $ 685 | $ 3,399 | ||

Accrued expenses | 5,682 | 4,659 | ||

Income taxes payable | — | 2,799 | ||

Deferred revenue | 1,733 | 1,000 | ||

Operating lease liabilities | 1,265 | — | ||

Total current liabilities | 9,365 | 11,857 | ||

Deferred rent, net of current portion | — | 11 | ||

Income taxes payable, net of current portion | 295 | 295 | ||

Deferred revenue, net of current portion | 2,867 | 4,000 | ||

Operating lease liabilities, net of current portion | 6,078 | — | ||

Total liabilities | 18,605 | 16,163 | ||

Commitments and contingencies | ||||

Shareholders' equity: | ||||

Common shares, no par value, unlimited shares authorized as of June 30, 2021 | — | — | ||

Additional paid-in capital | 420,799 | 407,672 | ||

Accumulated other comprehensive income | 337 | 44 | ||

Accumulated deficit | (157,585) | (113,203) | ||

Total shareholders' equity | 263,551 | 294,513 | ||

Total liabilities and shareholders' equity | $ 282,156 | $ 310,676 | ||

FUSION PHARMACEUTICALS INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In thousands, except share and per share amounts) (Unaudited) | ||||||||

Three Months Ended | Six Months Ended | |||||||

2021 | 2020 | 2021 | 2020 | |||||

Collaboration revenue | $ 521 | $ — | $ 521 | $ — | ||||

Operating expenses: | ||||||||

Research and development | 21,146 | 3,325 | 31,862 | 7,702 | ||||

General and administrative | 6,642 | 3,988 | 13,606 | 8,315 | ||||

Total operating expenses | 27,788 | 7,313 | 45,468 | 16,017 | ||||

Loss from operations | (27,267) | (7,313) | (44,947) | (16,017) | ||||

Other income (expense): | ||||||||

Change in fair value of preferred share tranche right liability | — | (31,604) | — | (32,722) | ||||

Change in fair value of preferred share warrant liability | — | (6,065) | — | (6,399) | ||||

Interest income (expense), net | 97 | 22 | 193 | 169 | ||||

Refundable investment tax credits | — | 52 | — | 98 | ||||

Other income (expense), net | 331 | 325 | 379 | 128 | ||||

Total other income (expense), net | 428 | (37,270) | 572 | (38,726) | ||||

Loss before provision for income taxes | (26,839) | (44,583) | (44,375) | (54,743) | ||||

Income tax provision | (14) | (150) | (7) | (212) | ||||

Net loss | (26,853) | (44,733) | (44,382) | (54,955) | ||||

Unrealized gain on investments | 54 | — | 293 | — | ||||

Comprehensive loss | (26,799) | (44,733) | (44,089) | (54,955) | ||||

Reconciliation of net loss to net loss attributable to common shareholders: | ||||||||

Net loss | (26,853) | (44,733) | (44,382) | (54,955) | ||||

Dividends paid to preferred shareholders in the form of | — | — | — | (1,382) | ||||

Net loss attributable to common shareholders | $ (26,853) | $ (44,733) | $ (44,382) | $ (56,337) | ||||

Net loss per share attributable to common shareholders—basic and | $ (0.63) | $ (18.91) | $ (1.05) | $ (26.23) | ||||

Weighted-average common shares outstanding—basic and diluted | 42,501,321 | 2,366,198 | 42,145,435 | 2,147,876 | ||||

FUSION PHARMACEUTICALS INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) | ||||

Six Months Ended June 30, | ||||

2021 | 2020 | |||

Cash flows from operating activities: | ||||

Net loss | $ (44,382) | $ (54,955) | ||

Adjustments to reconcile net loss to net cash used in operating activities: | ||||

Share-based compensation expense | 3,863 | 784 | ||

Depreciation and amortization expense | 265 | 270 | ||

Non-cash lease expense | 516 | 14 | ||

Change in fair value of preferred share tranche right liability | — | 32,722 | ||

Change in fair value of preferred share warrant liability | — | 6,399 | ||

Amortization of premiums (accretion of discounts) on investments, net | 924 | — | ||

Deferred tax benefit | (413) | — | ||

Common shares issued to acquire in-process research & development | 8,924 | — | ||

Foreign exchange loss | 36 | — | ||

Changes in operating assets and liabilities: | ||||

Accounts receivable | (121) | — | ||

Prepaid expenses and other current assets | (374) | (103) | ||

Other non-current assets | (1,509) | — | ||

Accounts payable | (2,687) | (319) | ||

Accrued expenses | 673 | 1,209 | ||

Deferred revenue | (400) | — | ||

Income taxes payable | (2,800) | 162 | ||

Operating lease liabilities | (418) | — | ||

Net cash used in operating activities | (37,903) | (13,817) | ||

Cash flows from investing activities: | ||||

Purchases of investments | (132,137) | — | ||

Maturities of investments | 107,591 | — | ||

Purchases of property and equipment | (793) | (382) | ||

Net cash used in investing activities | (25,339) | (382) | ||

Cash flows from financing activities: | ||||

Proceeds from issuance of Class B convertible preferred shares and Class B preferred | — | 65,676 | ||

Proceeds from issuance of Class B preferred exchangeable shares of Fusion | — | 6,722 | ||

Proceeds from the issuance of common shares upon closing of initial public offering, | — | 197,625 | ||

Payment of offering costs | — | (2,276) | ||

Proceeds from issuance of common shares upon exercise of stock options | 340 | — | ||

Net cash provided by financing activities | 340 | 267,747 | ||

Net (decrease) increase in cash, cash equivalents and restricted cash | (62,902) | 253,548 | ||

Cash, cash equivalents and restricted cash at beginning of period | 92,408 | 67,121 | ||

Cash, cash equivalents and restricted cash at end of period | $ 29,506 | $ 320,669 | ||

Supplemental disclosure of cash flow information: | ||||

Cash paid for income taxes | $ 3,494 | $ 50 | ||

Right-of-use assets obtained in exchange for new operating lease liabilities | $ 1,166 | $ — | ||

Increase in right-of-use assets and operating lease liabilities from operating lease | $ 911 | $ — | ||

Supplemental disclosure of non-cash investing and financing activities: | ||||

Purchases of property and equipment included in accounts payable and accrued expenses | $ 199 | $ — | ||

Issuance of warrants to purchase Class B preferred shares and Class B preferred | $ — | $ 1,382 | ||

Deferred offering costs included in accounts payable and accrued expenses | $ 160 | $ 2,296 | ||

FUSION PHARMACEUTICALS INC. | ||||||||

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL RESULTS | ||||||||

(In thousands) | ||||||||

(Unaudited) | ||||||||

Three Months Ended | Six Months Ended | |||||||

2021 | 2020 | 2021 | 2020 | |||||

GAAP Net loss | $ (26,853) | $ (44,733) | $ (44,382) | $ (54,955) | ||||

Less: Adjustments | ||||||||

Change in fair value of preferred share tranche right liability | — | (31,604) | — | (32,722) | ||||

Change in fair value of preferred share warrant liability | — | (6,065) | — | (6,399) | ||||

Non-GAAP Net loss | $ (26,853) | $ (7,064) | $ (44,382) | $ (15,834) | ||||

SOURCE Fusion Pharmaceuticals Inc.